Understanding the Appraisal Process:

|

||||||||||||

| |

| Our inspection is not the same as a Home Inspection, although it shares similarities. While Home Inspectors look at the condition of the property for issues and needed repairs, we are analyzing other factors as well, such as location and the specific features that impact value. |

What happens during the inspection?

During the inspection, the appraiser will physically measure the building(s) to ensure the stated square footage is accurate, and can illustrate the layout of the home, as the inspection often requires creating a sketch of the floor plan. The appraiser identifies any obvious features - or defects - that would have an impact on the value of the property, including the quality of construction, and any updating that has been done to the property. What is the Appraisal Process?

Following the inspection, multiple approaches are used to determine the value of real property: A Sales Comparison, a Replacement Cost Calculation, and an Income Approach when rental properties are prevalent. These are often referred to as "The Three Approaches to Value".Approach #1: The Sales Comparison Approach

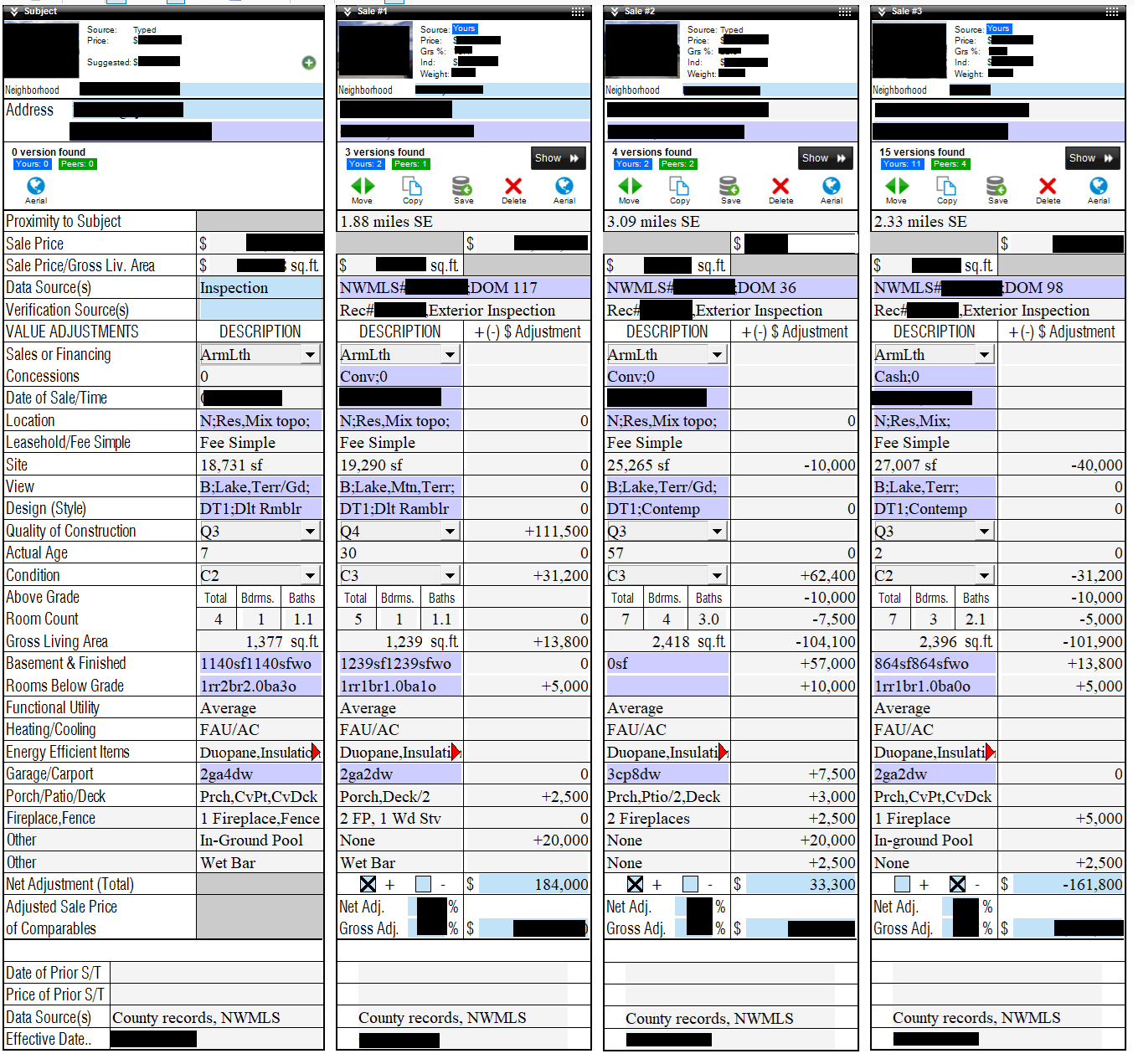

Also called the Market Approach, the Sales Comparison Approach takes recent sales of similar properties in the subject’s area and compares them on a grid. Direct comparisons and valuation adjustments are made for items such as location, square footage, bedroom/bathroom count, amenities, and more.Comparing the subject to recently sold properties in the subject’s area, we adjust the comparable properties so that they more accurately match the features of subject property. For example, a comparable has a fireplace

and the subject does not, the appraiser may subtract the value of a fireplace from the sales price of the comparable to equate it to the subject. In the inverse, if the subject has something such as an extra bathroom that a comparable does not have, the appraiser will add the value of that bath to the comparable property.

Using knowledge of the value of certain items such as square footage, additional bathrooms, hardwood floors, fireplaces or view lots (just to name a few), we adjust the comparable properties so that they more accurately match the features of subject property.

| ||

| The Sales Comparison Approach provides the most reliable support for

market value and is typically awarded the most importance when an

appraisal is for a home purchase. | ||

| ||

Approach #2: The Cost Approach

The cost approach is the estimated reproduction or replacement cost of a property. Taking into account the estimated value of the site, plus the depreciated cost of the building, and any other improvements.Here, we gather information on local building costs, labor rates and other factors to determine how much it would cost to construct a property comparable to the one being appraised. This value usually sets the upper limit on what a property would sell for. The cost approach is generally the least used method, but it remains an important approach to value.

Approach #3: The Income Approach

The third way of valuing a property is sometimes applied when a neighborhood has a reasonable number of rental properties. In this scenario, the amount of revenue the real estate produces is factored in with other rents in the area for comparable properties to derive the current value.